NCBE uses a 1099 service provided by Yearli Greatland to prepare and distribute our 1099 tax forms. Those nonemployee payees who were paid $600 or more during calendar 2024 will receive a 1099-NEC tax form in the mail and will also receive an email with a link to securely access their tax form online.

These forms will be mailed and emailed to the addresses that you specified during the NextGen research sign-up process. Please make sure that the email and mailing addresses that you entered during sign-up are still accurate for delivery of tax documents in January 2025. You can review and edit the information that you provided by accessing the sign-up application using the following link: https://bar-prototype.ncbex.org.

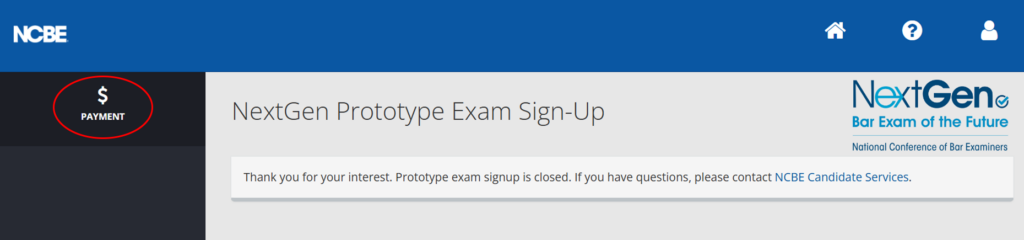

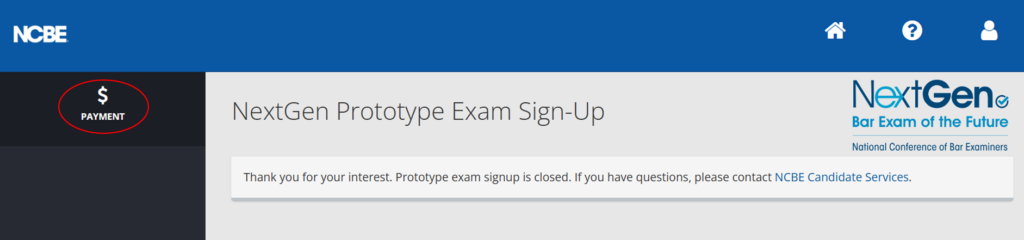

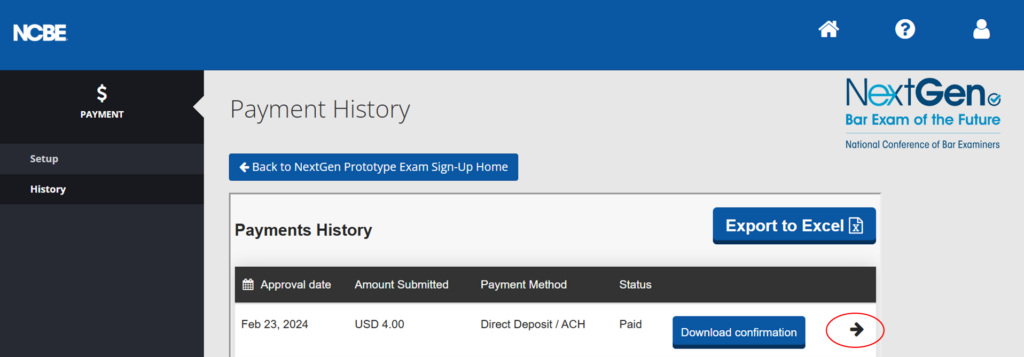

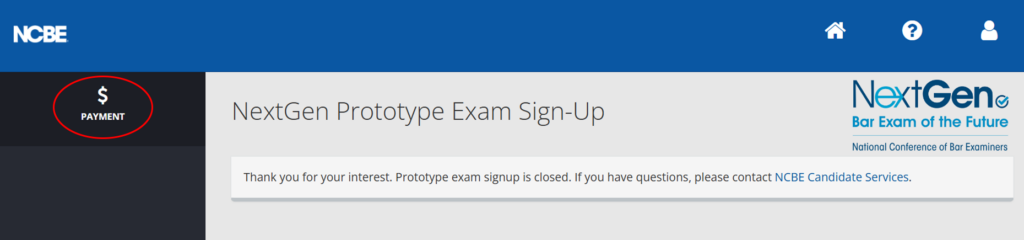

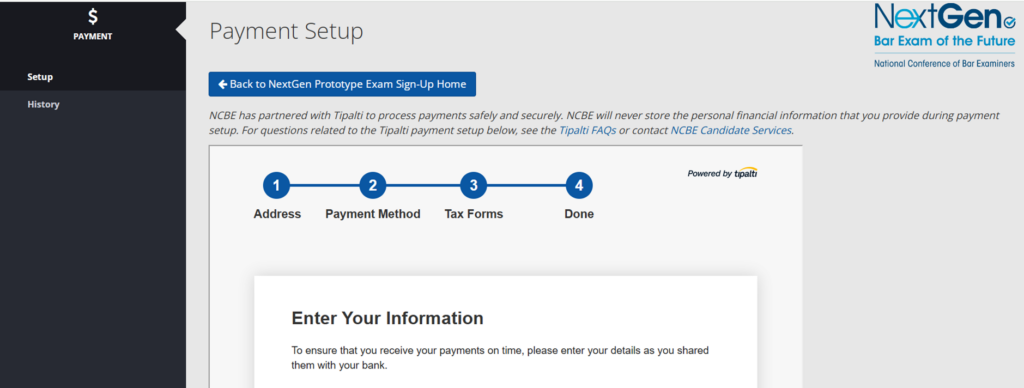

Once you log in to your account, you should see the screen below. Please click on Payment in the menu on the left-hand side of the screen.

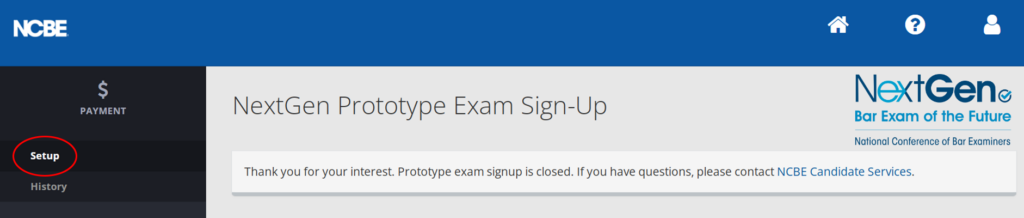

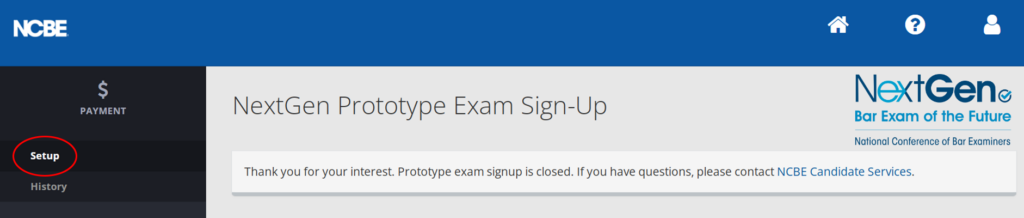

A drop-down menu will appear. Select Setup to access the contact information that you provided during sign-up.

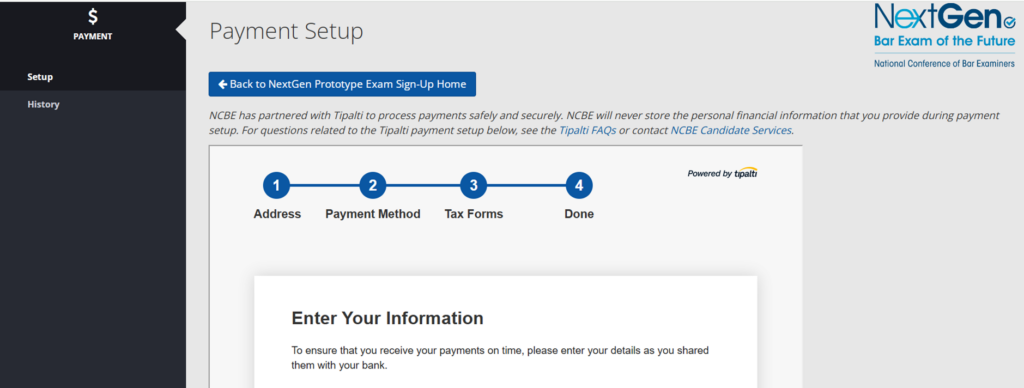

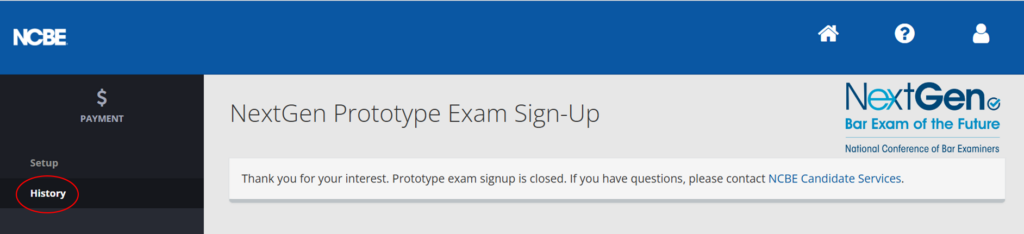

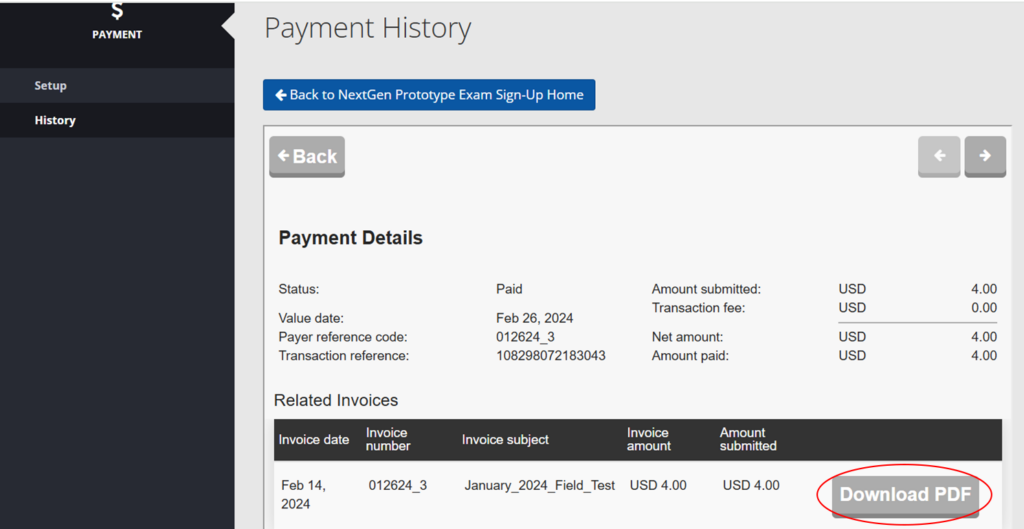

When you click on Setup the screen below will appear.

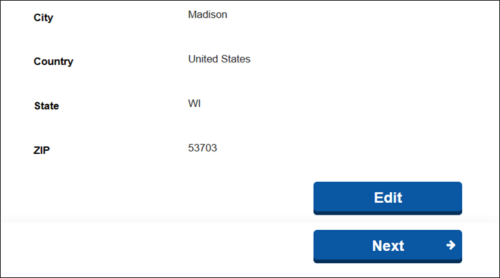

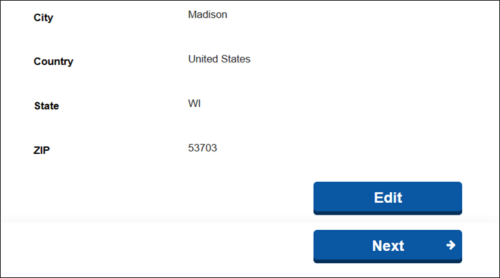

Please review the Contact Email and the mailing address information on the first tab. To make changes, click on Edit at the bottom of the address information tab.

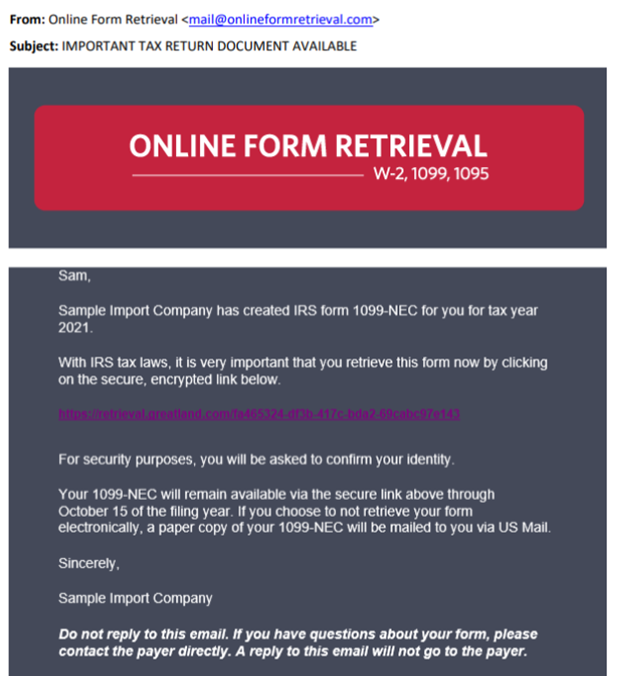

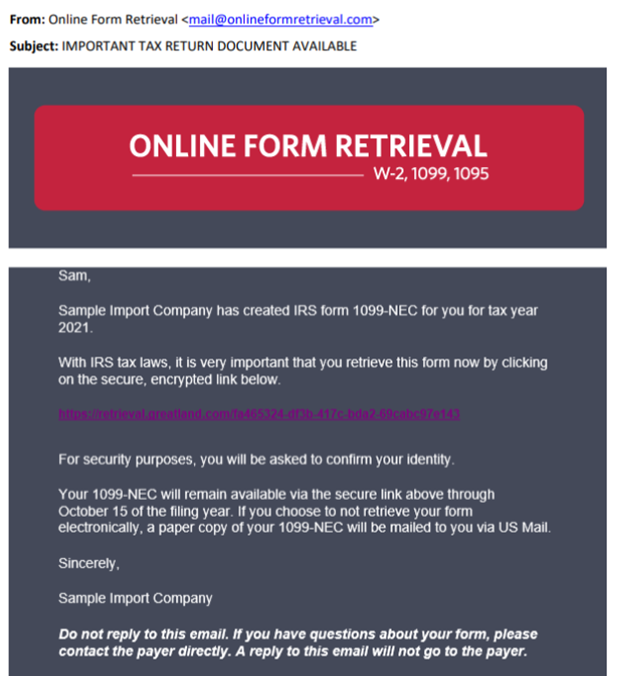

Below is an example of the email that you will receive from our 1099 service provider in January 2025. The email will come from Online Form Retrieval <mail@onlineformretrieval.com>. The company noted in the body of the email will be “National Conference of Bar Examiners” rather than “Sample Import Company.” Please check your spam folder to make sure that you receive your 1099 email.

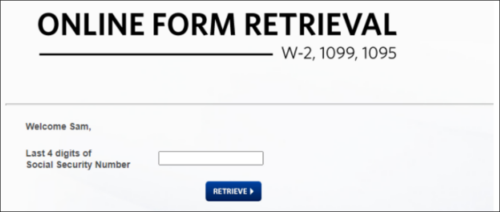

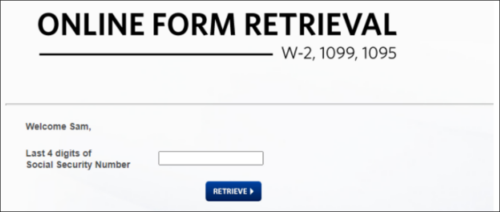

When you click on the encrypted link in the body of the email, you should see the screen below.

After you enter the last four digits of your Social Security number and click Retrieve, the following screen will appear. Click on the link to access a PDF copy of your 1099-NEC tax form. Please be sure to save a copy for your records, as the link provided in the email will only be accessible through October 15, 2025.